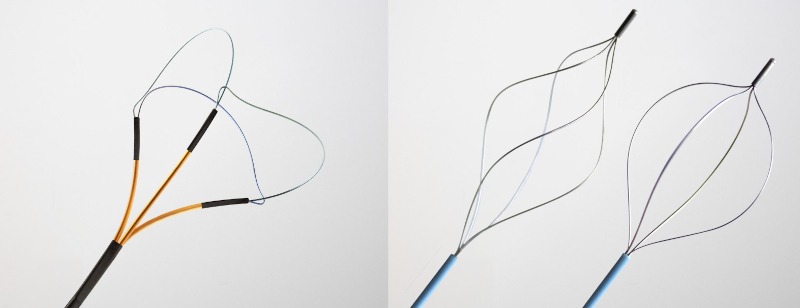

As a further step towards strengthening its position in the medical segment, Alleima has signed an agreement to acquire Endosmart Gesellschaft für Medizintechnik GmbH (Endosmart), a Germany-based manufacturer of medical instruments, implants and components made from the shape memory alloy nitinol. The product range includes kidney stone baskets and loops, breast cancer tumor markers and surgical instruments.

Endosmart offers products and services to medical device companies, primarily in the fields of urology, oncology, cardiology, and instruments for orthopedic and vascular applications. The company is reported within Alleima’s Kanthal division.

“Our strategy is focused on profitable growth, and we see great potential in the medical industry, which is characterized by high growth and stable earnings. The acquisition of Endosmart expands our capabilities and expands our currently addressable market with new products and materials. We look forward to welcoming Endosmart to Alleima,” says Göran Björkman, President and CEO of Alleima.

With complementary material technologies and Endosmart’s expertise and capabilities in processing nitinol, the acquisition enables forward-looking integration into the value chain of the medical industry. Endosmart’s product and service offerings, certifications and existing customer base expand the currently addressable market for Alleima. The combined expertise and presence will drive further product development and geographic expansion through cross-sales between product portfolios and regions, as well as opportunities to share production and application capabilities.

“We have a long-term strategic commitment to grow our medical device business. With the acquisition of Endosmart, we will continue to expand our range of medical wires and components while expanding our research and development capabilities to develop and offer new, unique solutions,” says Gary Davies, Head of the Medical Business Unit at Kanthal.

“We have a long-term strategic commitment to grow our medical device business. With the acquisition of Endosmart, we will continue to expand our range of medical wires and components while expanding our research and development capabilities to develop and offer new, unique solutions,” says Gary Davies, Head of the Medical Business Unit at Kanthal.

Endosmart was founded in 2002, has more than 90 employees and is headquartered in Karlsruhe, Germany. In the last twelve months to September 2022, the company generated sales of around SEK 105 million and an EBIT margin neutral for Kanthal. The parties have agreed not to disclose the purchase price. The impact on Alleima’s earnings per share will initially be neutral. The transaction is expected to close by the end of 2022 and is subject to customary approvals.

Related links: