Covid-19 has exposed undeniable vulnerabilities in the medical supply chain. Natalie Healey explores how the pandemic will change the way health systems procure equipment in the future – and what OEMs can do to stay competitive – with Fiona Miller from the Institute of Health Policy at the University of Toronto.

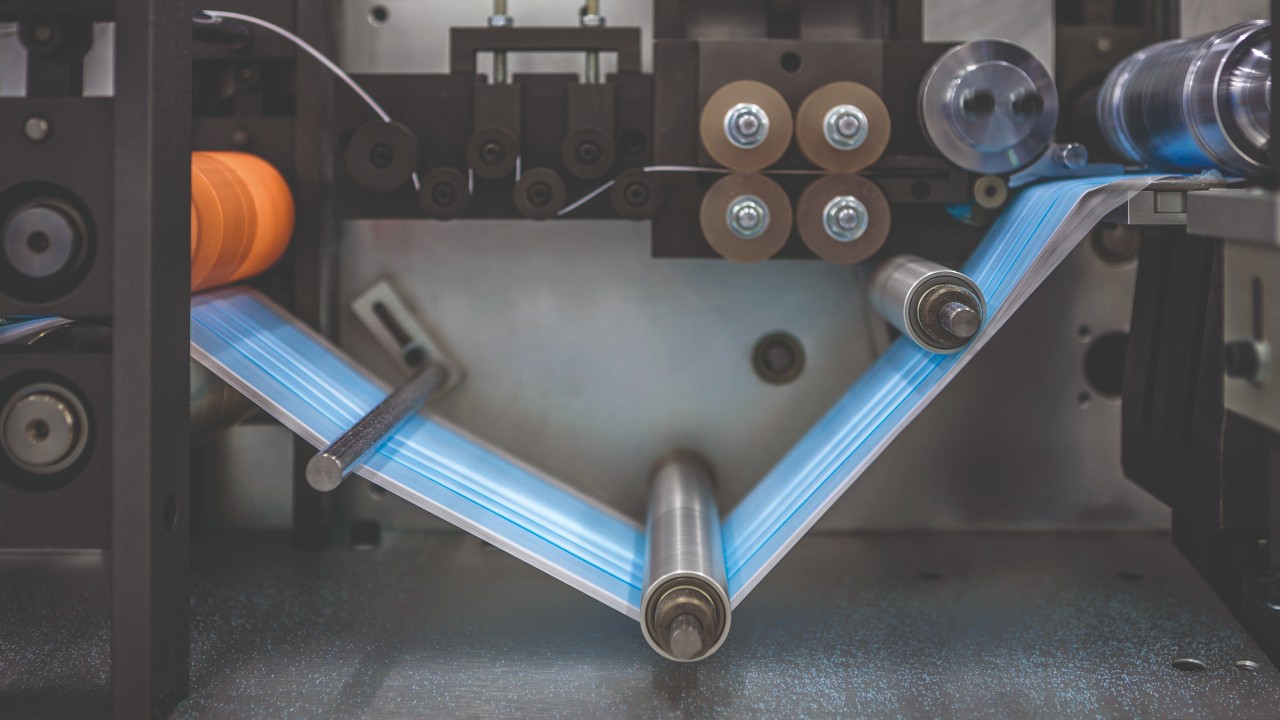

Medics marched into battle without armour at the start of the coronavirus crisis. Masks, gloves and gowns were in short supply across most of the world, leaving healthcare professionals and social care workers inadequately protected against a deadly airborne pathogen.

As the disease spread around the globe, shortages of other medical products such as ventilators and diagnostic tests became widespread too. Everybody wanted them, but few could get their hands on them.

So, counterfeit devices flooded the market and prices for health products soared. Governments scrambled to find secure solutions. But the genie could not be put back in the bottle. The fragilities in the medical device supply chain had been exposed for all to see.

These problems were there hiding in plain sight all along, says Fiona Miller from the Institute of Health Policy at the University of Toronto. It just took a black swan event like Covid-19 to shine a spotlight on the medical device supply chain’s shortcomings.

One reason for the neglect, she believes, is that governments have tended to focus their efforts on ironing out supply chain issues with pharmaceuticals rather than medical devices. “Some of the really long-standing supply problems are in generic injectables, which are fairly complex to manufacture,” she reveals.

“The problems of supply on the medical device side are less well known.” But Covid-19 isn’t the first disaster to cause widespread disruption to the medical supply chain, she points out.

In 2017, Hurricane Maria led to an acute shortage of sterile saline solutions when manufacturing capacity concentrated in Puerto Rico was badly hit.

Leaders should have known that personal protective equipment (PPE) was likely to be particularly vulnerable in a disaster scenario, says Miller, because the products can be manufactured cheaply but have limited margins of profit.

For this reason, it makes financial sense for many countries to source masks and gowns from abroad. It’s a strategy that works until it doesn’t. Most of the world’s PPE stock is manufactured in China – and everyone knows why that became a problem at the beginning of 2020.

The globalised medical product strategy began to unravel when a mystery disease was discovered in Hubei province, one of China’s manufacturing hubs. As Wuhan locked down hard, PPE factories pivoted to favour their domestic customers and turned off the tap to much of the rest of the world.

In March 2020, WHO estimated that fighting coronavirus would take the planet’s healthcare workers 89 million masks, 76 million pairs of gloves and 1.6 million sets of goggles every month.

“Without secure supply chains, the risk to healthcare workers around the world is real,”

said WHO director-general Dr Tedros Adhanom Ghebreyesus at the time.

“Industry and governments must act quickly to boost supply, ease export restrictions and put measures in place to stop speculation and hoarding. We can’t stop Covid-19 without protecting health workers first.” But international solidarity broke down and a global scrum for protective equipment ensued.

Change in priorities for the supply chain

It wasn’t just masks. At the start of the pandemic, many countries stopped exporting more expensive medical devices too. India, for instance, banned the export of all types of ventilators on 24 March 2020.

Such events prompted analytics company GlobalData to predict that countries will favour domestic production for key medical devices

once the pandemic retreats.

“From a risk-analysis perspective, relying on imports of essential medical devices is a serious threat to public health security,” said the company’s medical device analyst Tina Deng in a press release.

More than a year into the crisis, Ronald Leibman, head of transportation at law firm McCarter and English says there is still a clear case for increased domestic production capacity for medical devices.

“These practices will not in the short term eliminate the US medical device [industry’s] dependence on overseas suppliers such as China,” he cautions.

“But creating efficiencies and redundancies will minimise or eliminate supply chain disruptions, and assure that hospitals and healthcare providers do not face shortages of critical machines again.”

There is also a social responsibility argument for home-grown medical equipment. Domestic manufacturers have been operating on an unlevel playing field for decades, says Miller. “They are expected to compensate for low, and sometimes appalling labour and environmental standards in the country of origin of these products.”

But health systems are realising that environmental commitments matter. The NHS, which is responsible for up to 5% of the UK’s carbon footprint, has committed to becoming ‘net zero’ for greenhouse gas emissions by 2040.

Miller predicts that procurement teams in the UK and elsewhere will place more importance on their suppliers’ green credentials than they have in the past.

Supply chain priorities may have changed across all industries because of the crisis. Consulting company McKinsey surveyed 400 companies about their procurement objectives and found the mood had shifted considerably.

Executives previously rated increased productivity and minimised costs as the most important factors in purchasing decisions.

But the unique circumstances of the pandemic have shown the value of agility and flexibility in operations. McKinsey’s Susan Lund summed it up well on the company’s October podcast.

“We’ve spent 25 years creating these incredibly complicated, complex global supply chains. And they were designed for cost and efficiency, but without really a thought to what could go wrong along the way.”

Covid-10 pushes for smarter manufacturing

The question for healthcare OEMs will be how they can stay competitive and even thrive when normal life resumes. Josh Blackmore, global healthcare market manager at M. Holland Company, which makes resins for the medical device industry, says the pandemic has driven many healthcare OEMs to move production closer to demand to improve flexibility and reduce stock-outs.

But he believes there will be great opportunities for medtech companies post-Covid-19. “I predict a strong renaissance to occur for many industries including healthcare,” he says.

“Many technologies such as 3D printing, telemedicine, wearables, point of care testing, artificial intelligence and robotics have received a huge boost in investment because of their performance in this extreme environment.”

Some of these technologies (dubbed industry 4.0) are primed to change manufacturing for good. “The coronavirus pandemic should be a wake-up call to the international manufacturing sector,” wrote the authors of a World Economic Forum report in June 2020.

They suggested smarter manufacturing could help suppliers survive in a global marketplace, which will likely prioritise agile and flexible production systems.

The FDA also seems convinced that industry 4.0 methods will strengthen public health infrastructure in the US. In January 2021, it announced a partnership with the National Institute of Standards and Technology to develop and implement advanced manufacturing technologies.

Modularisation will be one focus, so the same facility can seamlessly switch production from one pharmaceutical or device to another in a matter of hours. Adaptive process controls that use AI and computational models to boost the efficiency of manufacturing lines are another target of interest.

Exploring new technologies could be a shrewd move for OEMs, agrees a report from PA Consulting. The company found that over 60% of manufacturers plan to invest in smart digital technologies, such as modular production lines, greater automation and use of data to improve planning and risk management, across the supply chain.

But the pandemic is not over yet. While the world crosses its fingers that vaccines will get it out of this mess, the future remains shrouded in uncertainty. At the time of writing, many of the world’s healthcare systems are running out of oxygen.

Without a crystal ball, it is impossible for medical device manufacturers and health procurement teams to know what the new normal will look like and what opportunities they should harness when they get there. Plus, not all healthcare OEMs have weathered the same storm over the past year.

Makers of ventilators and PPE have seen hugely increased demand, but other medical equipment manufacturers’ sales have slowed as surgeries were postponed while health systems battled the virus.

It may be tempting for some companies to continue existing practice and hope for the best until Covid-19 is extinguished, but Miller cautions against burying heads in the sand.

“There are multiple trajectories forward,” she says. “But if I was advising companies, I’d point to arguments about levelling the playing field for domestic manufacturers in ways that are supportive of economic opportunity for communities and environmental responsibility.”

This article first appeared in Medical Device Development Vol. 1 2021. The full publication can be viewed online here.