GE Healthcare has agreed to acquire global intraoperative imaging and surgical navigation company BK Medical for $1.45bn in cash.

Based in Boston and Copenhagen, BK Medical offers advanced ultrasound technology and an active imaging platform that consists of advanced software algorithms.

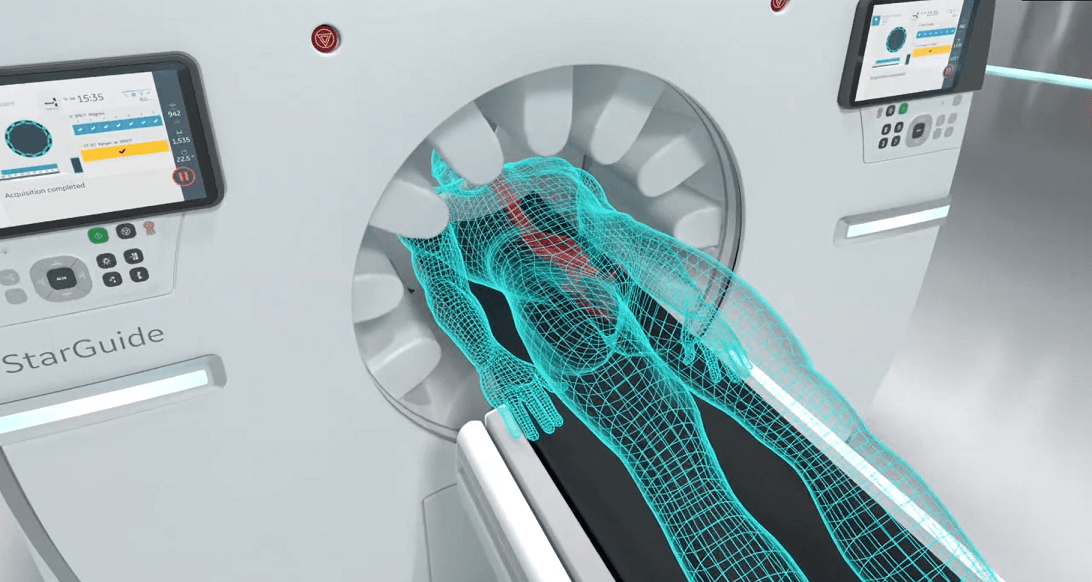

The company’s solutions are designed to help surgeons to make real-time and data-based decisions during surgical procedures to deliver enhanced clinical outcomes and reduced costs for patients, physicians, and the healthcare system.

BK Medical’s intraoperative imaging and surgical navigation capabilities will guide clinicians during minimally invasive and robotic surgeries, as well as visualise deep tissue during procedures in neuro and abdominal surgery, and in ultrasound urology.

BK Medical, which protects its technology with more than 136 patent families, has a global installed base of over 14,000 ultrasound platforms. The company employs around 650 people.

BK Medical president and CEO Brooks West said: “Combining our expertise in intraoperative imaging and surgical navigation with GE Healthcare’s many strengths and global presence will accelerate our mission to change the standard of care in surgical interventions.”

The acquisition will enable GE Healthcare to expand its $3bn ultrasound business from diagnostics to surgical and therapeutic interventions.

The deal will also boost the company’s growth in precision health, as well as add capability in the advanced surgical visualisation segment.

GE Healthcare president and CEO Kieran Murphy said: “Ultrasound today forms an integral part of many care pathways, and BK Medical is a strategic and highly complementary addition to our growing and profitable Ultrasound business.

“This transaction helps GE Healthcare continue to expand beyond diagnostics into surgical and therapeutic interventions, simplifying decision-making for clinicians and equipping them with greater insights to deliver faster, more personalized care for their patients—representing another step toward delivering precision health.”

Subject to review by the relevant regulatory authorities, the deal is expected to be completed by the end of this year.

Evercore served as an exclusive financial advisor, while Gibson, Dunn and Crutcher acted as legal advisor to GE on the deal.

J.P. Morgan Securities acted as a lead financial advisor to BK Medical in connection with the transaction. Morgan Stanley served as financial advisor and Latham Watkins and Schiff Hardin acted as its legal advisor.